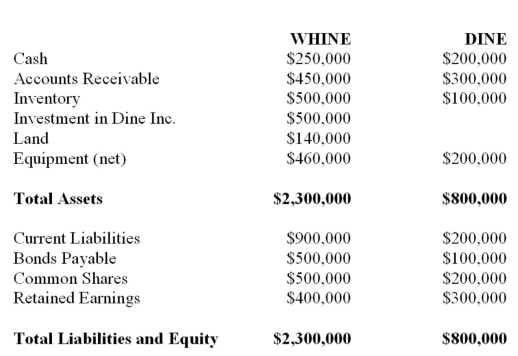

Whine purchased 80% of the outstanding voting shares of Dine Inc. on December 31, 2012. The Balance Sheets of both companies on that date are shown below (after Whine acquired the shares) :  Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. What would be Whine's ownership interest in Dine following Chompster's purchase of shares in Dine?

Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. What would be Whine's ownership interest in Dine following Chompster's purchase of shares in Dine?

Definitions:

Decision-Making Responsibility

The obligation or duty to make choices that will influence outcomes, often involving the allocation of resources or direction of efforts.

Household Chores

Routine tasks and maintenance work carried out in the maintenance and operation of a household, such as cleaning, cooking, and gardening.

Workload

The amount of work assigned to or expected from a person within a specific time frame.

Child Care

The care and supervision of children, typically from infancy through elementary age, by someone other than the child's legal guardians.

Q2: Compute the critical value <span

Q6: On December 31, 2012, A Company has

Q20: Ting Corp. owns 75% of Won Corp.

Q21: Prior to July 2001, the required treatment

Q24: You received a $5,000 loan at the

Q36: Errant Inc. purchased 100% of the outstanding

Q39: Which of the following perspectives is normally

Q43: The net-realizable-value method is the least preferred

Q46: Indirect costs:<br>A) can be traced to a

Q50: Which of the following statements is correct?<br>A)