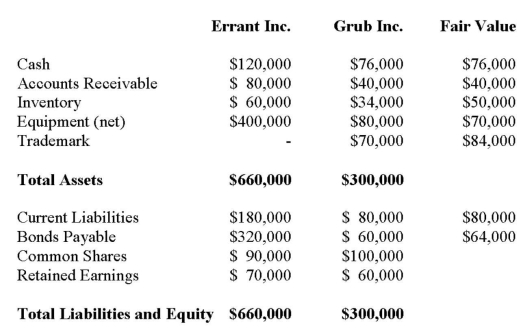

Errant Inc. purchased 100% of the outstanding voting shares of Grub Inc. for $200,000 on January 1, 2012. On that date, Grub Inc. had common stock and retained earnings worth $100,000 and $60,000, respectively. Goodwill is tested annually for impairment. The Balance Sheets of both companies, as well as Grub's fair market values on the date of acquisition are disclosed below:  The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. The amount of Retained Earnings appearing on the Consolidated Balance Sheet as at January 1, 2012 would be:

The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. The amount of Retained Earnings appearing on the Consolidated Balance Sheet as at January 1, 2012 would be:

Definitions:

Common Form

A standardized or widely used version of a document, agreement, or legal form.

Value

The importance, worth, or usefulness of something to individuals or society.

Pattern Recognition

The process of identifying patterns in data, enabling recognition, categorization, and prediction.

Entrepreneurial Opportunity

A favorable set of circumstances that creates a need for a new product, service, or business.

Q4: Some of the ways that JIT efficiencies

Q5: True or False: The general form

Q16: ABC invested $30 million in cash

Q17: The Financial Statements of Plax Inc. and

Q18: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" GWN

Q30: Income-smoothing has been applied to a German

Q47: Parent and Sub Inc. had the following

Q57: Do-Good Inc. is a newly formed not-for-profit

Q67: When allocating service department costs, companies should

Q81: Which of the following is an example