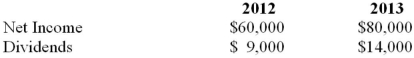

On January 1, 2012, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 outstanding voting shares for $240,000. On that date, Marvin's common stock and retained earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair market value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively. On January 1, 2013, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair market values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful life was revised to 5 years on this date. Marvin's net Income and dividends for 2012 and 2013 are as follows:  Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What percentage of Marvin's shares was purchased by Hanson on January 1, 2012?

Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What percentage of Marvin's shares was purchased by Hanson on January 1, 2012?

Definitions:

Loci

Specific fixed positions on chromosomes where genes or genetic markers are located.

Chromosome

Chromosomes are long, thread-like structures made of DNA and proteins, found in the nucleus of most living cells, carrying genetic information in the form of genes.

Epistasis

Condition in which certain alleles of one locus alter the expression of alleles of a different locus.

Alleles

Different forms of a gene that arise by mutation and are found at the same place on a chromosome.

Q6: If the functional currency of the foreign

Q8: The purchase price of an entity includes:<br>A)

Q11: Collins Company, which pays a 10% commission

Q12: Using ONLY the assets test, determine which

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Nil. B)

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q16: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q47: Terrence Industries charges manufacturing overhead to products

Q48: The following balance sheets have been prepared

Q54: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) All individual