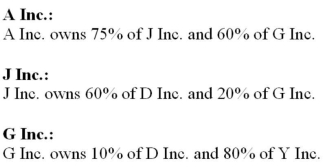

The following information pertains to the shareholdings of an affiliated group of companies. The respective ownership interest of each company is outlined below.  All intercompany investments are accounted for using the equity method. The Net Incomes for these companies for the year ended December 31, 2012 were as follows:

All intercompany investments are accounted for using the equity method. The Net Incomes for these companies for the year ended December 31, 2012 were as follows:  Unrealized intercompany profits (pre-tax) earned by the various companies for the year ended December 31, 2012 are shown below:

Unrealized intercompany profits (pre-tax) earned by the various companies for the year ended December 31, 2012 are shown below:  All companies are subject to a 25% tax rate. What is the Consolidated Net Income for the year attributable to the shareholders of A Inc.?

All companies are subject to a 25% tax rate. What is the Consolidated Net Income for the year attributable to the shareholders of A Inc.?

Definitions:

Decentralisation

The distribution of decision-making power away from a central authority within an organization.

Specialised Information

Information that is tailored to meet the specific needs or requirements of a particular domain or profession.

Profit Centre Manager

An individual responsible for a division or segment of an organization whose performance is measured in terms of profitability.

Investment Centre Manager

A manager responsible for a business unit that is judged on its investment, revenue, and cost performance.

Q4: Clandestine Corporation allocates joint costs by using

Q11: On June 30, 2012, Parent Company sold

Q20: Which of the following is not a

Q25: Compound interest is interest earned not only

Q26: Which of the preceding activities would likely

Q36: The following balance sheets have been prepared

Q42: When the Non-Controlling Interest's share of the

Q68: The left side of the Manufacturing Overhead

Q73: Templeton Corporation recently used $75,000 of direct

Q78: Which of the four items listed below