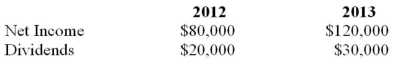

Rin owns 90% of Stempy Inc. On January 1, 2012, the investment in Stempy account had a balance of $350,000 and Stempy's common stock and retained earnings on that date were valued at $200,000 and $100,889 respectively. Moreover, the assets to which the unamortized acquisition differential relates had a remaining life of 10 years on that date. Rin uses the equity method to account for its investment in Stempy. Rin sold depreciable assets to Stempy on January 1, 2012 at an after-tax gain of $10,000. On January 1, 2013, Stempy sold depreciable assets to Rin at an after-tax gain of $20,000. Both assets are being depreciated over 10 years. Stempy's Net Income and Dividends for 2012 and 2013 are shown below.  What is the total amount of unrealized profit (after-tax) remaining at the end of 2013?

What is the total amount of unrealized profit (after-tax) remaining at the end of 2013?

Definitions:

Women

Female human beings; also refers to issues, conditions, and perspectives specific to them, particularly in contexts of health, society, and rights.

Stomach Enzyme

Stomach enzymes, like pepsin, are chemicals in the stomach that play a critical role in the digestion of proteins into peptides, facilitating the digestive process.

Drinking

The act of consuming liquids, commonly referring to the consumption of alcoholic beverages.

Brain

The complex organ located in the skull, responsible for controlling most functions of the body and mind, including cognition, emotion, memory, and motor skills.

Q5: Section 404 of the Sarbanes-Oxley Act, Management

Q10: LEO Inc. acquired a 60% interest in

Q13: The Financial Statements of Plax Inc. and

Q18: One weakness associated with the Entity Theory

Q24: Whine purchased 80% of the outstanding voting

Q28: Do-Good Inc. is a newly formed not-for-profit

Q32: Non-Controlling Interest is presented in the Shareholders'

Q40: Which of the following would not be

Q46: Any goodwill on the subsidiary company's books

Q112: The marginal cost when the twenty-first student