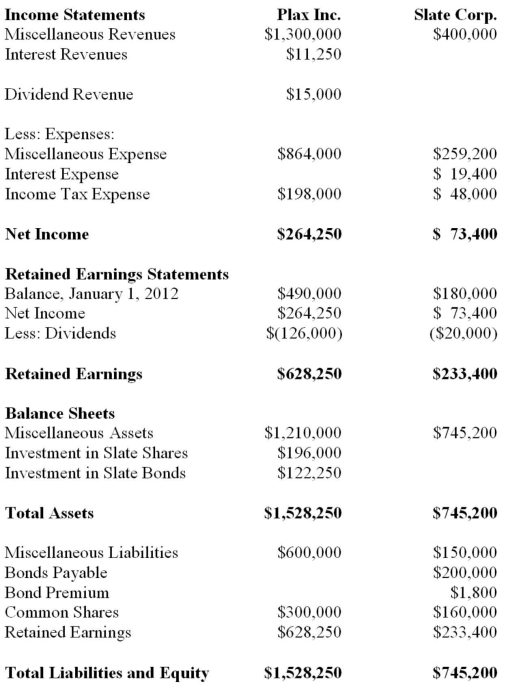

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 chapters)  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Prepare a Calculation of Non-Controlling Interest as at December 31, 2012 for Plax Inc.

Definitions:

Balance Sheet

A report that encapsulates a business's assets, debts, and owner's equity at a certain date.

Financial Leverage

The use of borrowed funds with a fixed cost in an effort to amplify the potential return to shareholders.

Bonds Payable

Long-term liabilities represented by documents promising to pay a specified sum of money at a future date plus periodic interest payments to bondholders.

Accounts Payable

Represents the amounts owed by a company to its creditors for goods and services purchased on credit.

Q6: If an investor is reporting in compliance

Q6: Kho Inc. purchased 90% of the voting

Q6: If the functional currency of the foreign

Q8: Prior to the implementation of IFRSs in

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q14: Lawson Company invests $60,000 today and has

Q14: SNZ Inc. purchased machinery and equipment in

Q35: How would any management fees charged by

Q41: Great Western Manufacturing Inc. ("GWM") was acquired

Q73: The Covington Clinic has two service departments