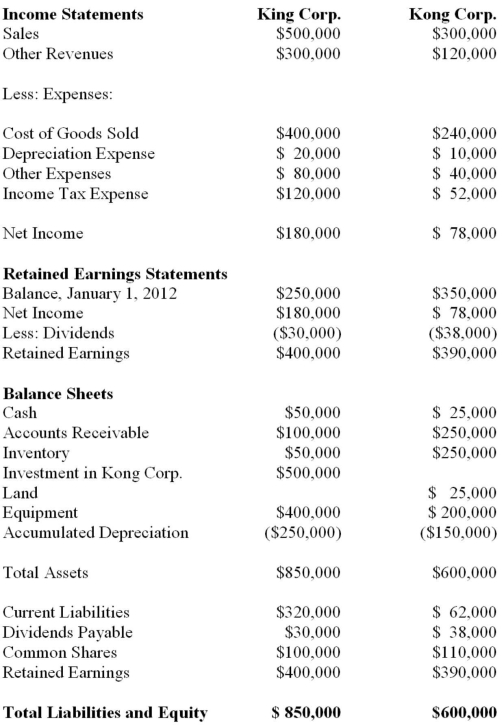

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapters) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. The amount of goodwill arising from this business combination is:

Definitions:

Adjunct Therapy

Treatment used together with the primary treatment to enhance its effectiveness.

Rheumatoid Arthritis

A chronic inflammatory disorder affecting the joints, including those in the hands and feet, characterized by pain, swelling, and stiffness.

Sarcoma

A type of cancer that arises from transformed cells of mesenchymal origin, affecting bones and soft tissues.

Lymphoma

A tumor of the lymphatic tissue.

Q5: One of the underlying assumptions of the

Q8: The risk exposure that occurs between the

Q13: A Corporation had net income of $50,000

Q32: Non-Controlling Interest is presented in the Shareholders'

Q35: How would any management fees charged by

Q52: Buana Fide is a local charity which

Q53: Duff Inc. owns 75% of Paddy Corp.

Q84: Manufacturers have established a cost classification called

Q101: A 90% confidence interval for the mean

Q112: The marginal cost when the twenty-first student