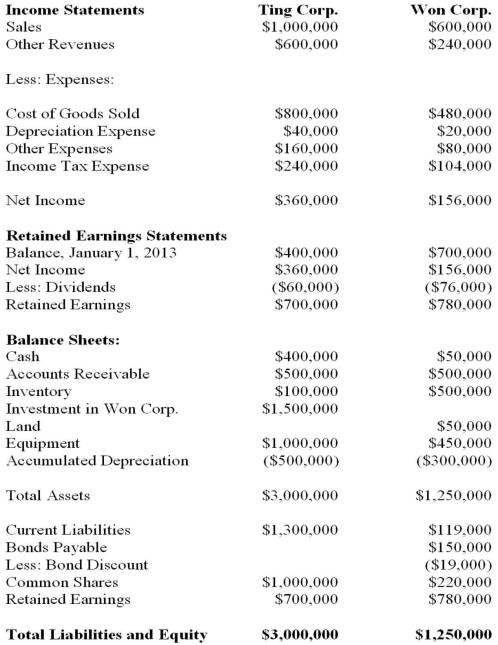

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, chapters) for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. What would be the amount of consolidated patents appearing on Ting's Consolidated Statement of Financial Position as at December 31, 2013?

Definitions:

Connotation

The implied or associated meaning of a word or phrase, apart from its explicit or primary definition.

Emotional Overtones

The emotional implications or connotations that accompany a word, phrase, or situation, influencing perceptions and reactions.

Implications

The possible effects or consequences of an action, statement, or event, especially where these are not explicitly stated.

Maturation

The process of becoming mature; the biological growth processes that enable orderly changes in behavior, mostly independent of experience.

Q6: The nature of managerial accounting reports is

Q12: An impairment loss can be reversed when:<br>A)

Q14: SNZ Inc. purchased machinery and equipment in

Q18: Managerial accounting:<br>A) is unregulated.<br>B) produces information that

Q18: Broadbent Industries carries a part that is

Q21: What monumental decision to change the requirements

Q37: After the introduction of the entity method

Q40: Contingent consideration will be classified as a

Q51: Describe the economic characteristics of sunk costs

Q97: Find the critical t-value that corresponds