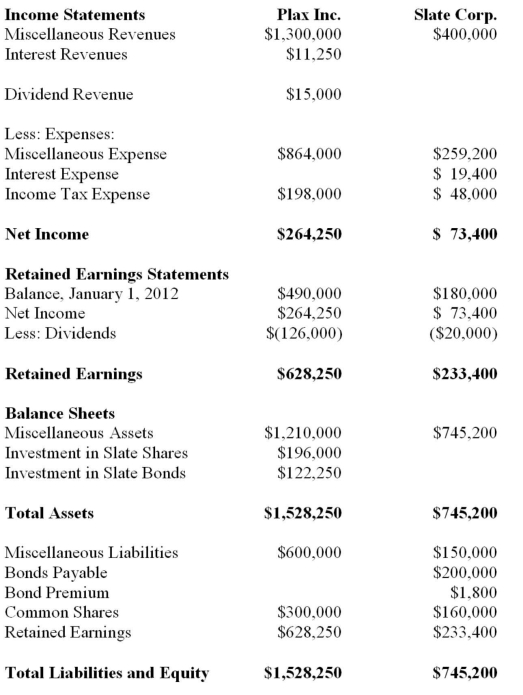

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 chapters)  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Prepare a detailed calculation of consolidated retained earnings as at January 1, 2012. Do not prepare a Statement of Retained Earnings for this requirement.

Definitions:

SWOT Analysis

A method of evaluating a proposed action that examines both internal factors (Strengths, Weaknesses) and external factors (Opportunities, Threats).

Ascent

Ascent refers to an upward movement or journey, often relating to physical elevation like climbing a mountain or career progression in a metaphorical sense.

Bypassing

Miscommunication that occurs when two people use the same language to mean different things.

Electronic Media

Platforms or channels that use electronics or digital technology to broadcast or distribute content.

Q3: Which of the following characteristic(s) relate(s) more

Q22: RXN's year-end is on December 31. On

Q27: Under which of the following Theories is

Q32: Section 4431 of the CICA Handbook contains

Q32: Briefly list the two types of legal

Q38: What are Canadian companies whose shares trade

Q53: A company that uses activity-based costing would

Q57: Do-Good Inc. is a newly formed not-for-profit

Q58: Under IFRS how are unrealized gains and

Q74: Every Student s t-distribution with n <