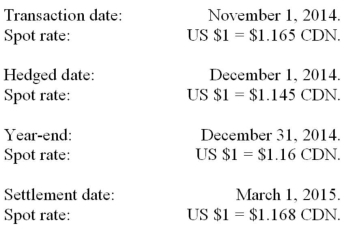

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  Assuming that the accounts receivable balance was not adjusted on December 1, 2014, what adjustment (if any) would be required to RXN's year-end accounts receivable balance?

Assuming that the accounts receivable balance was not adjusted on December 1, 2014, what adjustment (if any) would be required to RXN's year-end accounts receivable balance?

Definitions:

Compromise Policy

A compromise policy is a policy that is agreed upon through concessions from all parties involved, aiming for a middle ground solution.

Debt/Equity Ratio

Debt/Equity Ratio is a financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company's assets.

Compromise Policy

A strategy or approach that involves making concessions or finding a middle ground between different opinions or objectives in decision-making processes.

Cash Dividend

A distribution of a company's earnings to shareholders in the form of cash, indicating the company's underlying profitability and cash flow health.

Q4: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q12: An impairment loss can be reversed when:<br>A)

Q14: the number of emails received on any

Q17: When a contingent consideration arising from a

Q19: How is negative goodwill treated under the

Q22: King Corp. owns 80% of Kong Corp.

Q27: On January 1, 2012, Hanson Inc. purchased

Q39: The degree of accounting disclosure required tends

Q40: True or False: The chi-square distribution is

Q61: Alcor and Vax Inc, both Canadian private