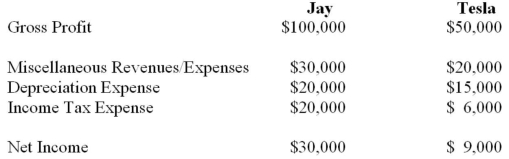

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2013 income statements of both companies are shown below.  On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of depreciation expense appearing on Jay's 2013 Consolidated Income Statement would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of depreciation expense appearing on Jay's 2013 Consolidated Income Statement would be:

Definitions:

High Tariffs

Elevated taxes imposed on imported goods to protect domestic industries by making foreign products more expensive compared to local products.

Trade Deficit

A situation where a country's imports exceed its exports during a specific time period, indicating a negative balance of trade.

Trade Deficits

Trade Deficits occur when a country's imports of goods and services exceed its exports, indicating an outflow of domestic currency to foreign markets.

Economic Colony

A region or country controlled by a foreign power for the purpose of economic exploitation, often through trade and resource extraction.

Q2: Unused or excess capacity is a key

Q6: On December 31, 2012, A Company has

Q9: LEO Inc. acquired a 60% interest in

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Nil. B)

Q9: Big Guy Inc. purchased 80% of the

Q22: The time value of money and present

Q32: All financial professionals, including managerial accountants, have

Q39: Parent and Sub Inc. had the following

Q48: Sparkle Metallurgy, Inc. has two service departments

Q70: Which of the following is not considered