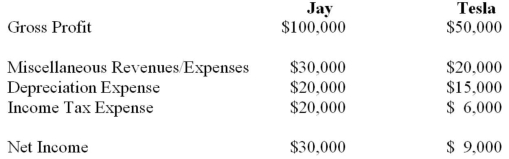

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2013 income statements of both companies are shown below.  On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of non-controlling interest in Jay's 2013 Consolidated Net Income would be:

On January 1, 2013, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%. The amount of non-controlling interest in Jay's 2013 Consolidated Net Income would be:

Definitions:

Weaknesses

Flaws or shortcomings within a business that may hinder its performance or ability to compete effectively.

SWOT Analysis Matrix

A strategic planning tool that helps identify Strengths, Weaknesses, Opportunities, and Threats related to business competition or project planning.

Strengths-Opportunities

Identifies areas where an organization has advantages and favorable conditions in its environment to leverage for success.

Consumer Needs

The requirements or desires of potential customers that drive their purchasing decisions.

Q5: One of the underlying assumptions of the

Q9: Ting Corp. owns 75% of Won Corp.

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Changes from

Q13: Which of the following statements about the

Q19: Which of the following would be considered

Q21: Prior to July 2001, the required treatment

Q26: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) It will

Q27: Reporting in accordance with the Accounting Standards

Q33: Ting Corp. owns 75% of Won Corp.

Q50: Which of the following would NOT be