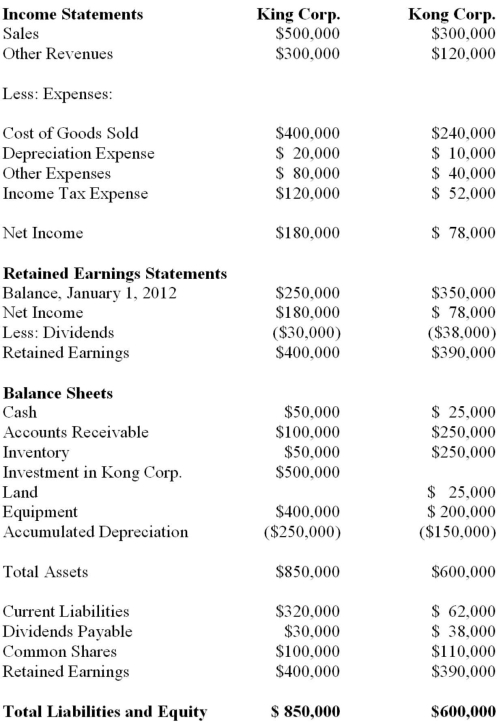

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapter) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What is the total amount of pre-tax profit from intercompany inventory sales that was realized during 2012?

Definitions:

Budget

An estimate of income and expenditure for a set period of time.

Master Budget

A comprehensive financial planning document that consolidates all of a company’s budgets for sales, production, overhead, administration, and others into one overall budget.

Safety Stock

An additional quantity of an item kept in the inventory to reduce the risk of stockouts due to uncertainties in supply and demand.

Budgeted Income Statement

A financial statement that projects income, expenses, and net profit for a future period based on management's expectations and budgeting process.

Q1: Which of the following is classified as

Q9: What is the total budgeted compensation for

Q14: Lawson Company invests $60,000 today and has

Q18: Ting Corp. owns 75% of Won Corp.

Q19: When a not-for-profit organization uses the deferred

Q20: Which of the following is not a

Q26: Kho Inc. purchased 90% of the voting

Q30: A significant influence investment is one that:<br>A)

Q38: <br>If the cost of goods manufactured

Q112: The marginal cost when the twenty-first student