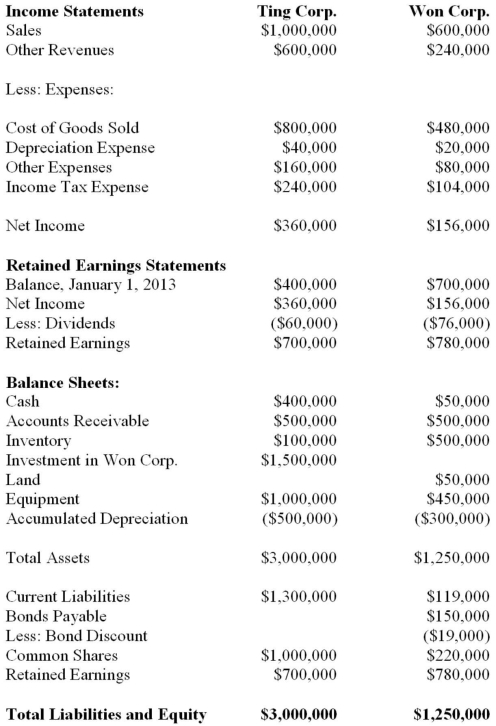

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, chapters) for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. The amount of goodwill arising from this business combination is:

Definitions:

Price Discrimination

A method of setting prices where a provider charges different amounts for the same or almost the same items or services to different customers or in various locations.

Monopoly Practices

Business actions by a monopolist aiming to acquire, enhance, or maintain its monopoly power, often to the detriment of consumers and competition.

Demand

The willingness and ability of consumers to purchase a quantity of a good or service at various prices during a specified period.

Price Discrimination

A pricing strategy where a seller charges different prices for the same product or service to different customers, based on factors like willingness to pay, customer location, or purchase volume.

Q1: Find Corp and has elected to use

Q3: The sum of the discount factors applicable

Q6: If the cost of goods sold for

Q13: Using the direct method, the amount of

Q14: According to IAS 29, the term "hyper-inflationary"

Q14: Telecom Inc has decided to purchase the

Q19: Which of the following entities would most

Q33: The Gross Margin at Split-Off method should

Q39: The maximum amortization period specified by Section

Q64: Which of the following is not an