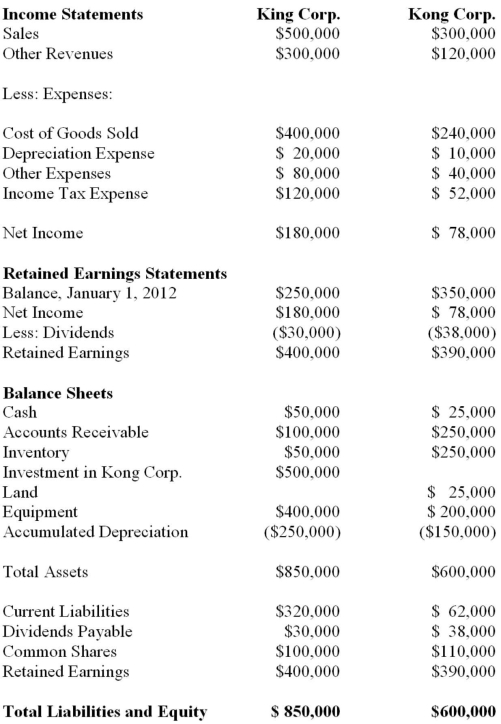

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapters) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the amount of consolidated patents appearing on King's Consolidated Statement of Financial Position as at December 31, 2012?

Definitions:

Stored

Kept or accumulated for future use.

Present Value

The present-day valuation of an anticipated amount of money or cash flows, considering a predetermined rate of return.

Endowment

An economic term referring to all assets, financial and non-financial, given to an individual or institution for a specific purpose.

Asset Returns

The income generated from investing in financial or physical assets, usually expressed as a percentage of the purchase price.

Q10: Which decision has Canada made with respect

Q20: Which of the following is not a

Q23: The following are selected transactions from Helpers

Q29: Which of the following can be linked

Q47: The Financial Statements of Plax Inc. and

Q53: Duff Inc. owns 75% of Paddy Corp.

Q85: Manufacturing costs are classified into four categories.

Q88: The choices below depict five costs of

Q95: The area under the graph of

Q96: A standardized test has a mean of