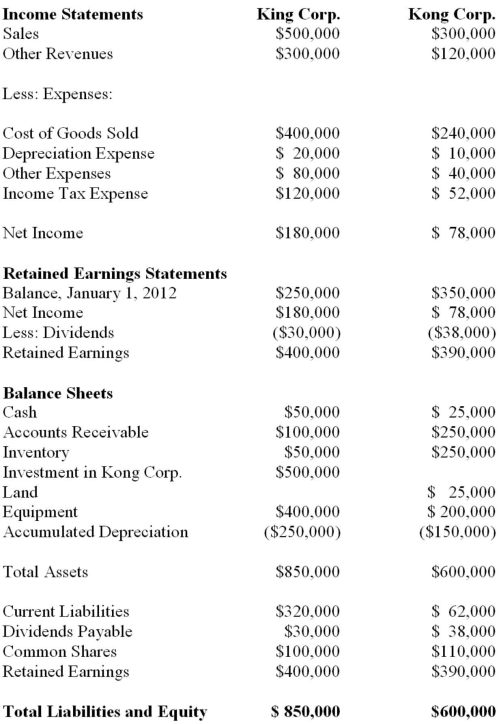

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, which it acquired on January 1, 2012. The Financial Statements of King Corp. and Kong Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. Ignoring income taxes and any minority interest effects, what is the amount of profit realized during 2012 from the intercompany sale of equipment?

Definitions:

Responsibility

The state or fact of having a duty to deal with something or having control over someone.

Practical Life Skills

Essential skills that enable individuals to manage and live their lives efficiently, such as cooking, budgeting, and time management.

Yorkshire Terrier

A small dog breed of terrier type, known for its long, silky coat and lively personality.

Miley Cyrus

An American singer, songwriter, and actress known for her dynamic voice and controversial image.

Q7: The provisions of section 302 of the

Q8: In order to set rates, an insurance

Q14: Errant Inc. purchased 100% of the outstanding

Q15: The provisions of sections 302 and 404

Q25: In an inflationary economy, under which consolidation

Q30: Give examples of each of the four

Q34: Big Guy Inc. purchased 80% of the

Q53: A not-for-profit organization receives a restricted contribution

Q59: Which of the following statements is correct?<br>A)

Q71: The position of chief financial officer (CFO)