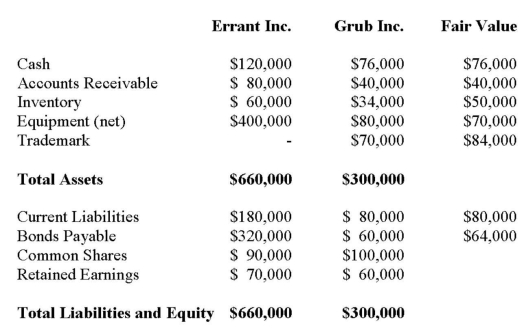

Errant Inc. purchased 100% of the outstanding voting shares of Grub Inc. for $200,000 on January 1, 2012. On that date, Grub Inc. had common stock and retained earnings worth $100,000 and $60,000, respectively. Goodwill is tested annually for impairment. The Balance Sheets of both companies, as well as Grub's fair market values on the date of acquisition are disclosed below:  The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. What would be Errant's journal entry to record the amortization of the acquisition differential (excluding any goodwill impairment) on December 31, 2012? (Assume that any difference between the fair values and book values of the equipment, trademark and bonds payable would all be amortized over 10 years.)

The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. What would be Errant's journal entry to record the amortization of the acquisition differential (excluding any goodwill impairment) on December 31, 2012? (Assume that any difference between the fair values and book values of the equipment, trademark and bonds payable would all be amortized over 10 years.)

Definitions:

First-Borns

A rephrased definition: The initial offspring in a family, often attributed with leadership qualities and higher responsibilities than their siblings.

Second-Borns

Individuals born as the second child in their family, potentially influencing their personality and social dynamics.

Self-Esteem

A reflection of one's overall subjective emotional evaluation of their own worth.

Competitive Or Ambitious

Describes individuals or behaviors driven by the desire to succeed or excel over others.

Q3: Sonic Enterprises Inc has decided to purchase

Q9: A national caterer determined that

Q17: The Financial Statements of Plax Inc. and

Q19: Prior to adoption of IFRS in 2011,

Q24: What is the dominant factor used to

Q45: During an acquisition, when should intangible assets

Q53: Which of the following provides the best

Q56: Which of the following statements is correct

Q59: Jay Inc. owns 80% of Tesla Inc.

Q61: Using the direct method, the amount of