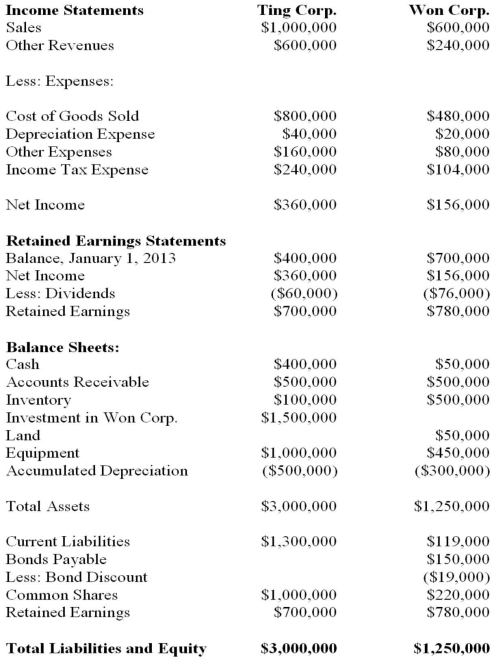

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, which it acquired on January 1, 2013. The Financial Statements of Ting Corp. and Won Corp. for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. Ignoring income taxes, what is the amount of profit/(loss) realized during 2013 from the intercompany sale of equipment?

Definitions:

Confederates

Individuals or entities aligned with or supportive of the Confederate States of America, a group of southern states that seceded from the United States leading to the American Civil War from 1861 to 1865.

Execution

Execution refers to the carrying out of a sentence of death on a person convicted of a capital crime, or it can also mean the act of performing a plan, order, or directive.

Ending Slavery

The process, legislative acts, and movements aimed at abolishing the practice of holding individuals in bondage or servitude against their will.

Northern Capitalists

Individuals from the northern United States, particularly during the 19th and early 20th centuries, who amassed wealth through industry and were instrumental in shaping the economy.

Q1: The procedure used to compute the future

Q11: An article a Florida newspaper reported

Q13: The following information pertains to the shareholdings

Q23: When are parent companies allowed to comprehensively

Q31: Ramos Corporation uses the physical-units method to

Q35: Which of the following is not included

Q36: On June 30, 2012, Parent Company sold

Q41: X Inc. owns 80% of Y Inc.

Q42: Which of the following regarding the preparation

Q69: Two things that all organizations have in