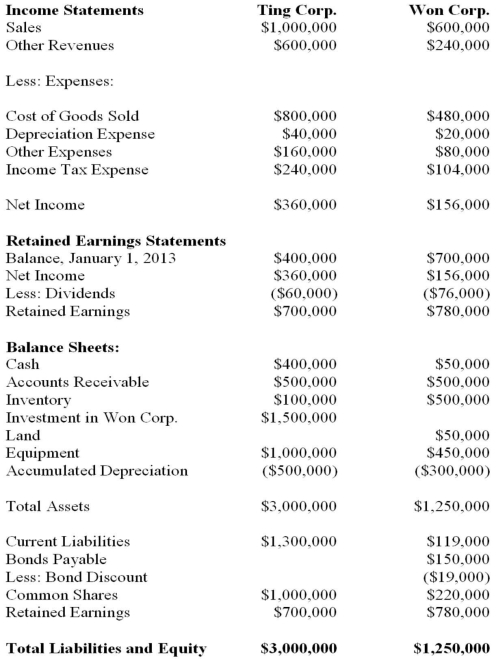

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, which it acquired on January 1, 2013. The Financial Statements of Ting Corp. and Won Corp. for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. Ignoring income taxes, what is the amount of unrealized profit/(loss) remaining from the intercompany sale of equipment at December 31, 2013?

Definitions:

Cohorts

groups of people banded together or treated as a group, often used in research to study changes across different age groups over time.

Cancer-causing Pesticides

Chemical substances used in agriculture that have been linked to the development of cancer in humans or animals.

Rubella

A contagious viral infection known as German measles, characterized by a distinctive red rash, primarily affecting children and young adults.

HIV

A virus that attacks the immune system, leading to acquired immunodeficiency syndrome (AIDS) if unchecked.

Q12: Which of the following is NOT a

Q26: Which of the preceding activities would likely

Q28: <br>If direct materials used during the year

Q38: What are Canadian companies whose shares trade

Q42: John Inc and Victor Inc for its

Q47: The Financial Statements of Plax Inc. and

Q47: As activity increases, unit variable cost:<br>A) increases

Q55: Which of the following statements about the

Q72: Hernandez Systems began business on January 1

Q91: Which type of production process is ideal