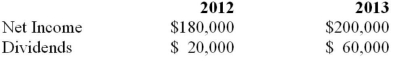

Hot Inc. owns 60% of Cold Inc, which it purchased on January 1, 2012 for $540,000. On that date, Cold's retained earnings and common stock were valued at $100,000 and $250,000 respectively. Cold's book values approximated its fair market values on that date, with the exception of the company's Inventory and a patent identified on acquisition. The patent had an estimated useful life of 10 years from the date of acquisition. The inventory had a book value that was $10,000 in excess of its fair value, while the patent had a fair market value of $50,000. Hot uses the equity method to account for its investment in Cold Inc. The inventory on hand on the acquisition date was sold to outside parties during the year. Hot Inc. sold depreciable assets to Cold on January 1, 2012, at a loss of $15,000. On January 1, 2013, Cold sold depreciable assets to Hot at a gain of $10,000 Both assets had a remaining useful life of 5 years on the date of their intercompany sale. During 2012, Cold sold inventory to Hot in the amount of $18,000. This inventory was sold to outside parties during 2013. During 2013, Hot sold inventory to Cold for $45,000. One third of this inventory was still in Cold's warehouse on December 31, 2013. All sales (both internal and external) are priced to provide the seller with a mark-up of 50% above cost. Cold's Net Income and Dividends for 2012 and 2013 are shown below.  Both companies are subject to a tax rate of 20%. Compute the Balance in Hot's Investment in Cold account as at December 31, 2013

Both companies are subject to a tax rate of 20%. Compute the Balance in Hot's Investment in Cold account as at December 31, 2013

Definitions:

Tubular Reabsorption

The process by which the nephrons in the kidneys return substances from the filtrate to the blood, effectively conserving water, salts, and nutrients.

Metabolic Waste Products

Substances left over from metabolic processes, which the body needs to excrete because they cannot be used and are harmful if accumulated.

Urine

A liquid by-product of metabolism in humans and many animals, excreted by the kidneys and containing waste materials.

Bladder

An organ that stores urine produced by the kidneys before it is expelled from the body.

Q7: Which of the following statements is correct?<br>A)

Q16: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" What

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q28: <br>If direct materials used during the year

Q32: Which of the following would not be

Q43: Under which accounting standards is the reporting

Q44: The relevant range for Maxco Industries is

Q61: A group of 49 randomly selected

Q67: Product costs are:<br>A) expensed when incurred.<br>B) inventoried.<br>C)

Q72: Hernandez Systems began business on January 1