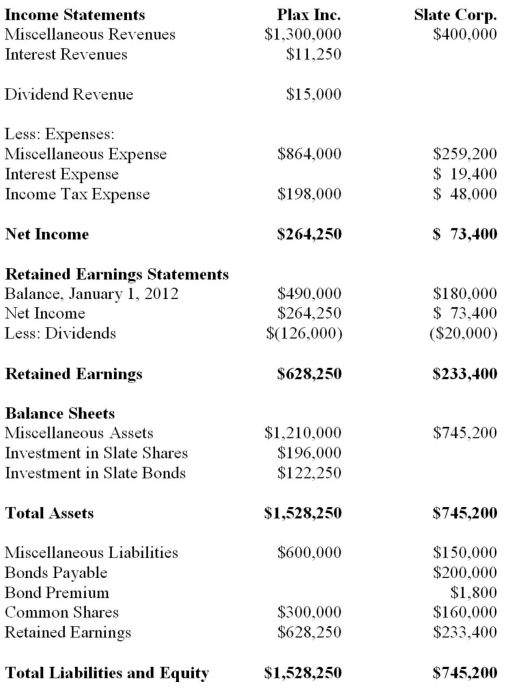

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 are shown below:  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Prepare a detailed calculation of Consolidated Net Income. Do not prepare an income statement for this requirement.

Definitions:

Net Income

The amount of earnings left over after all operational, financial, and tax expenses have been deducted from revenues, indicating the company's profitability.

Segment Reporting

The practice of breaking down financial reports into divisions, product lines, or geographical markets to provide detailed financial information.

Accounting Standards

Guidelines and rules established by accounting organizations for preparing and reporting financial statements.

International Financial Reporting Standards

A set of accounting standards and guidelines developed and maintained by the International Accounting Standards Board (IASB) that is used internationally to ensure financial statements are transparent, comparable, and consistent.

Q1: Find Corp and has elected to use

Q3: Whine purchased 80% of the outstanding voting

Q3: Accounting policies created in countries governed by

Q9: LEO Inc. acquired a 60% interest in

Q21: What monumental decision to change the requirements

Q45: What is the correct method of treating

Q57: Using the step-down method and assuming that

Q74: Every Student s t-distribution with n <

Q75: Which of the following employees would not

Q103: A computer package was used to generate