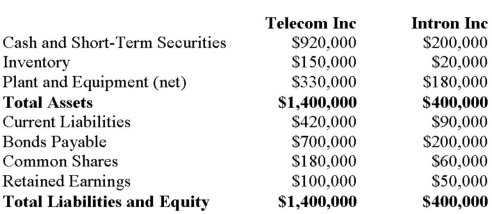

Telecom Inc has decided to purchase the shares of Intron Inc. for $300, 000 in Cash on July 1,2012. On the date, the balance sheets of each of these companies were as follows:  On that date, the fair values of Intron's Assets and Liabilities were as follows:

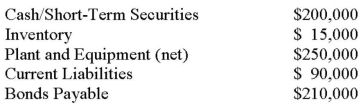

On that date, the fair values of Intron's Assets and Liabilities were as follows:  Assume that two days after the acquisition, the Goodwill was put to an impairment test, after which it was decided that its true value was $70,000. Prepare the necessary journal entry to write-down the goodwill as well as another Consolidated Balance Sheet to reflect the new Goodwill amount.

Assume that two days after the acquisition, the Goodwill was put to an impairment test, after which it was decided that its true value was $70,000. Prepare the necessary journal entry to write-down the goodwill as well as another Consolidated Balance Sheet to reflect the new Goodwill amount.

Definitions:

Q2: On January 1, 2012, Hanson Inc. purchased

Q8: The purchase price of an entity includes:<br>A)

Q10: Which decision has Canada made with respect

Q10: The amount of corn chips dispensed into

Q16: The average score of all golfers

Q21: Which of the following concerning the distinction

Q23: The following are selected transactions from Helpers

Q30: Grassley Corporation allocates administrative costs on the

Q102: As the level of confidence increases the

Q120: The area under the normal curve drawn