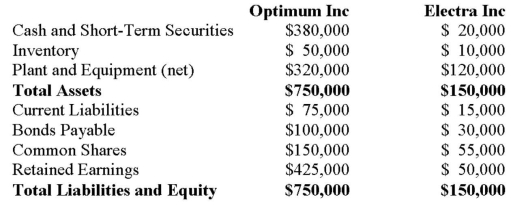

On April 1, 2012, the balance sheets of Optimum Inc. and Electra Inc. were as follows:  On that date, the fair values of Electra's Assets and Liabilities were as follows:

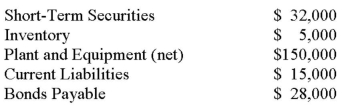

On that date, the fair values of Electra's Assets and Liabilities were as follows:  On April 1, 2012, Optimum issued 5,000 new common shares with a market value of $50.00 per share as consideration for Electra's net assets. Prior to the issue, Optimum had 10,000 outstanding common shares. a) Calculate the amount of Goodwill arising from this combination. b) Prepare the journal entry to record Optimum's acquisition of Electra's assets. c) Prepare Optimum's Consolidated Balance Sheet immediately following its acquisition of Electra's assets. d) Prepare Electra's Balance Sheet following the acquisition.

On April 1, 2012, Optimum issued 5,000 new common shares with a market value of $50.00 per share as consideration for Electra's net assets. Prior to the issue, Optimum had 10,000 outstanding common shares. a) Calculate the amount of Goodwill arising from this combination. b) Prepare the journal entry to record Optimum's acquisition of Electra's assets. c) Prepare Optimum's Consolidated Balance Sheet immediately following its acquisition of Electra's assets. d) Prepare Electra's Balance Sheet following the acquisition.

Definitions:

Public Saving

The difference between tax revenues and government spending, representing the amount of surplus or deficit in the government's budget.

Private Saving

The portion of households' income that is not used for consumption or paying taxes, and is instead saved.

Savers

Individuals or entities that set aside income or resources for future use, often with the intent of accumulating wealth or for future investment.

Investors

Individuals or institutions that allocate capital with the expectation of receiving financial returns, often involving investment in stocks, bonds, or real estate.

Q5: Section 404 of the Sarbanes-Oxley Act, Management

Q5: Consider the following statements about service department

Q8: What agreement was signed between the IASB

Q12: Using ONLY the assets test, determine which

Q12: A Inc. owns 80% of B's outstanding

Q16: On January 1, 2012, Hanson Inc. purchased

Q16: The economic order quantity is approximately:<br>A) 203

Q32: How should intangible assets which are readily

Q32: Which of the following is NOT currently

Q46: Determine the point estimate of the population