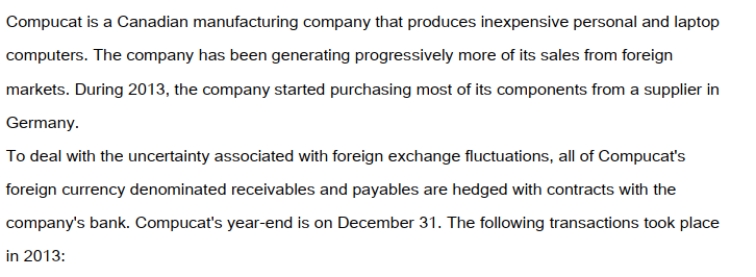

On September 1, 2013, Compucat purchased components from its German supplier for 100,000 Euros. On that date AMC entered into a forward contract for 100,000 Euros at the 60 day forward rate of 1Euro = $1.50CDN. The forward contract was designated as a fair value hedge of the amount payable to the German supplier. Compucat settled with the bank and paid its supplier in full on December 1, 2013. On December 1, 2013 Compucat also shipped a batch of laptop computers to an American client for $250,000US. The invoice required that Compucat receive its payment in full by January 31, 2013. On the date of the sale, the company entered into a forward contract for $250,000US at the two-month forward rate of $1US = $1.25CDN. This forward contract was designated to be a fair value hedge of the amount due from the American customer. The dates and exchange rates relevant to these transactions are shown below.

On September 1, 2013, Compucat purchased components from its German supplier for 100,000 Euros. On that date AMC entered into a forward contract for 100,000 Euros at the 60 day forward rate of 1Euro = $1.50CDN. The forward contract was designated as a fair value hedge of the amount payable to the German supplier. Compucat settled with the bank and paid its supplier in full on December 1, 2013. On December 1, 2013 Compucat also shipped a batch of laptop computers to an American client for $250,000US. The invoice required that Compucat receive its payment in full by January 31, 2013. On the date of the sale, the company entered into a forward contract for $250,000US at the two-month forward rate of $1US = $1.25CDN. This forward contract was designated to be a fair value hedge of the amount due from the American customer. The dates and exchange rates relevant to these transactions are shown below.  Prepare the December 31, 2013 Balance Sheet Presentation of the Receivable from the American client and the accounts associated with the hedge.

Prepare the December 31, 2013 Balance Sheet Presentation of the Receivable from the American client and the accounts associated with the hedge.

Definitions:

Basic Accounting Equation

The fundamental equation of double-entry bookkeeping, stating that assets equal liabilities plus owner's equity.

Transaction

An agreement or exchange between two parties that has a measurable financial effect on the accounts of a business.

Accounts

Financial records of transactions that track the income, expenses, assets, liabilities, and equity of an entity.

Double-Entry System

An accounting method that records each transaction in at least two accounts, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced.

Q14: Telecom Inc has decided to purchase the

Q14: X Inc. owns 80% of Y Inc.

Q30: Errant Inc. purchased 100% of the outstanding

Q31: A not-for-profit organization received unrestricted pledges of

Q33: LEO Inc. acquired a 60% interest in

Q50: Assuming that all conditions are met

Q60: John Inc and Victor Inc for its

Q95: <span class="ql-formula" data-value="\mathrm { z } =

Q96: If p is the probability of

Q102: Determine whether the following normal probability plot