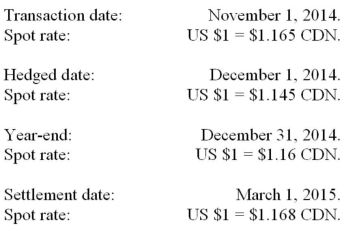

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  What is the amount of the discount on the forward contract?

What is the amount of the discount on the forward contract?

Definitions:

Global Minimum Variance Portfolio

An investment portfolio constructed to achieve the lowest possible risk (variance), given a set of securities.

Standard Deviation

Standard Deviation is a statistical measure that quantifies the amount of variation or dispersion of a set of data values.

Expected Rate of Return

The anticipated return on an investment, taking into account the probability of different possible returns.

Perfectly Negatively Correlated

A relationship between two variables in which one variable increases as the other decreases with a correlation coefficient of -1.

Q1: For a self-sustaining foreign operation, exchange gains

Q4: A recent survey found that 72% of

Q7: The following balance sheets have been prepared

Q19: Many people think that a national

Q33: The consolidation elimination entry required to remove

Q34: On June 30, 2012, Parent Company sold

Q36: Bequests are normally not recorded until:<br>A) the

Q41: Whine purchased 80% of the outstanding voting

Q73: Draw the probability histogram and label the

Q140: The random variable x represents the number