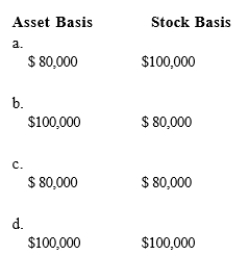

Chen contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a C corporation and the transaction qualifies under § 351, the corporation's basis for the property and the shareholder's basis for the stock are:

Definitions:

Income Statement

A financial statement that shows a company's revenues and expenses over a specific period, resulting in a net profit or loss.

Expected Residual Value

The anticipated value of an asset at the end of its useful life, important in calculating depreciation and lease payments.

Lease Rate

The amount of money paid over a specified time period for the use of an asset or property, typically expressed as an annual amount or percentage.

Operating Leases

Provides for both financing and maintenance. Generally, the operating lease contract is written for a period considerably shorter than the expected life of the leased equipment and contains a cancellation clause; sometimes called a service lease.

Q3: If the AMT base is greater than

Q20: Guaranteed payment

Q24: Describe the process of developing a total

Q27: List the external factors that shape internal

Q33: Which of the following is a disadvantage

Q33: With lump-sum bonuses, employees receive an end-of

Q38: U.S.income tax treaties:<br>A)Involve three to seven countries

Q60: The MOP Partnership is involved in construction

Q69: Items that are not required to be

Q75: BlueCo incurs $900,000 during the year to