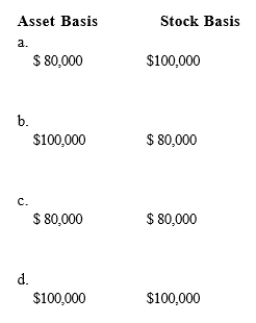

Ruchi contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a partnership and the transaction qualifies under § 721, the partnership's basis for the property and the partner's basis for the partnership interest are:

Definitions:

Database Table

A structure within a database used to organize and store data in rows and columns, allowing for easy data management, query, and manipulation.

Rows and Columns

The horizontal and vertical lines in a table or grid that organize data, with rows running horizontally and columns running vertically.

Microsoft Project

A project management software product, developed and sold by Microsoft, designed to assist project managers in developing plans, assigning resources to tasks, tracking progress, managing budgets, and analyzing workloads.

Medium-sized Projects

Projects that are neither small nor large in scope, complexity, and resource requirements, often requiring detailed planning and management.

Q6: § 179 deduction

Q15: What are the two major categories of

Q17: Net capital loss

Q18: To align the interest of the directors

Q20: Which of the following job evaluation methods

Q33: USCo, a U.S.corporation, receives $700,000 of foreign-source

Q36: Compensable factors must be consistent with the

Q39: The property factor includes land and buildings

Q54: With respect to the criteria used to

Q72: A limited partnership can indirectly avoid unlimited