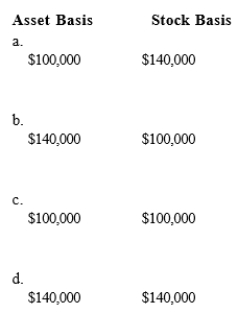

Martin contributes property with an adjusted basis of $100,000 and a fair market value of $140,000 to a newly formed business entity.If the entity is an S corporation and the transaction qualifies under § 351, the S corporation's basis for the property and the shareholder's basis for the stock are:

Definitions:

Internal Locus

A psychological term referring to individuals who believe they have control over the outcomes of their actions and life events.

Adaptation-Level Phenomenon

The psychological process by which individuals adjust their expectations and standards based on previous experiences, influencing their perception of new stimuli.

Type B Personality

A disposition typified by its placid, lenient, and relaxed manner.

External Locus

A belief system where individuals perceive their outcomes in life as being controlled by external forces or chance.

Q1: All taxpayers are eligible to take the

Q8: An organization adopts a marketing approach to

Q16: Brooke and John formed a partnership.Brooke received

Q19: Discuss three possible explanations for extremely high

Q29: Dark, Inc., a U.S.corporation, operates Dunkel, an

Q45: Describe the role of a union in

Q54: Section 482 is used by the U.S.Treasury

Q76: In deciding whether to enact the alternative

Q78: A corporation may alternate between S corporation

Q132: The taxable income of a partnership flows