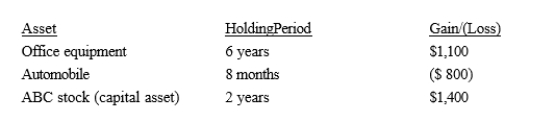

The following assets in Jack's business were sold in 2018:  Office equipment, purchased for $8,000, had a zero adjusted basis.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2018 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

Office equipment, purchased for $8,000, had a zero adjusted basis.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2018 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

Definitions:

Unrealistic Expectations

Expectations that are not reasonable or achievable, often leading to disappointment or failure.

Personal Sacrifices

Personal sacrifices are acts of giving up something valued for the sake of other considerations or the welfare of others, often seen as a form of self-discipline or commitment.

Gen X'ers

Individuals born approximately between 1965 and 1980, known for their adaptability, technological adeptness, and independent work ethic.

Guanabara Bay

A large oceanic bay located in southeastern Brazil, known for its beautiful views and environmental challenges.

Q2: Grace's sole source of income is from

Q6: Kiddie tax applies

Q9: Under the terms of a divorce agreement

Q22: Josie, an unmarried taxpayer, has $155,000 in

Q49: Two years ago, Gina loaned Tom $50,000.Tom

Q55: On a particular Saturday, Tom had planned

Q59: On July 10, 2019, Ariff places in

Q90: During the current year, Ralph made the

Q93: The maximum cost recovery method for all

Q113: On the recommendation of a physician, Ed