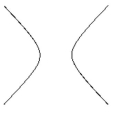

Name the conic.

-

Definitions:

Exercise Price

In options trading, it is the price at which the holder can buy (call option) or sell (put option) the underlying security.

Black-Scholes Model

A mathematical model used to price European-style options, evaluating their worth based on stock volatility, risk-free rate, and other factors.

Option Theta

A measure of the rate of decline in the value of an options contract due to the passage of time.

Underlying Asset

The financial asset upon which a derivative's value is based, such as stocks, bonds, commodities, or currencies.

Q9: Selling price and percent of advertising

Q12: A sample of 33 companies was

Q12: A soft drink dispenser can be adjusted

Q13: A consumer research group is interested in

Q14: A correlation of zero between two quantitative

Q16: Selling price and percent of advertising

Q33: <span class="ql-formula" data-value="\sum _ { k =

Q55: A flat rectangular piece of aluminum has

Q57: f(x) =x<sup>2</sup>-4x-5<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7856/.jpg" alt=" f(x) =x<sup>2</sup>-4x-5

Q81: <span class="ql-formula" data-value="f ( x ) =