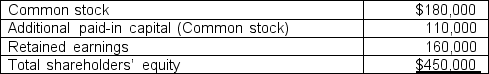

The shareholders' equity section of Jason Company as of December 31, 2010 follows:

On January 15, the company repurchased 1,500 shares of its own common stock at $60 to hold as treasury stock. Which of the following would be included in the journal entry recorded on January 15?

On January 15, the company repurchased 1,500 shares of its own common stock at $60 to hold as treasury stock. Which of the following would be included in the journal entry recorded on January 15?

a. a credit to Retained Earnings for $90,000.

b. a debit to Cash for $90,000.

c. a debit to Treasury Stock for $90,000.

d. a debit to Common Stock for $90,000.

Definitions:

Partnership Assets

Resources owned jointly by partners in a partnership arrangement, used in the operation of the partnership business.

Cash Distribution

The payment of earnings or capital to shareholders, stakeholders, or partners by a corporation or fund.

Noncash Assets

Assets that cannot be quickly converted into cash, such as real estate, equipment, and inventory.

Liabilities

Financial obligations or debts owed by a business to external parties or individuals.

Q7: On May 6, 2010, Galen Company purchased

Q20: Collecting sales taxes from customers<br>A) decreases net

Q23: Gleeson Industries consists of four separate divisions:

Q58: Which of the following correctly describe comets?

Q74: Which of the following is an advantage

Q75: The most common geologic setting of diamonds

Q81: When the effective interest method is used

Q83: Describe the two cash flows associated with

Q92: Rio Grande Company purchased equipment on January

Q141: Which of the following is NOT a