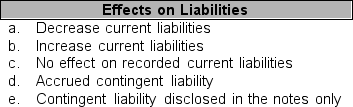

For each item numbered 1 through 16 below, select the appropriate effect on liabilities listed in a through e that each transaction describes. You may use each letter more than once or not at all. In some cases, two effects are correct.

____ 1. Purchased supplies on account.

____ 1. Purchased supplies on account.

____ 2. Paid accounts payable.

____ 3. Issued a $1,000 short-term note payable for $970.

____ 4. Amortized the discount of the short-term note payable.

____ 5. A portion of long-term debt is due next year.

____ 6. Declared cash dividends to holders of stock.

____ 7. Paid the cash dividend previously declared.

____ 8. Received money from customers prior to delivery of the product to the customer.

____ 9. Delivered products to a customer who previously paid for that product.

____ 10. Collected sales tax on behalf of the state government.

____ 11. Accrued payroll taxes that the firm has to pay to the federal government within three months.

____ 12. Accrued a bonus amounting to 5% on reported income to the CEO.

____ 13. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is remote.

____ 14. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is reasonably possible.

____ 15. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is highly probable.

____ 16. Accrued warranty expense.

Definitions:

After-Tax Discount Rate

The interest rate used in discounting cash flows that takes into account the tax implications of the investment.

Incremental Sales

The additional revenue generated from a specific business decision or action.

Cash Operating Expenses

Expenses incurred during the normal operation of a business that affect its cash position, such as rent, utilities, and payroll, excluding non-cash expenses like depreciation.

Working Capital

The difference between a company's current assets and its current liabilities, indicating the liquidity and operational efficiency of the business.

Q31: For each transaction listed in 1 through

Q38: Which one of the following actions will

Q39: A company should report a cumulative effect

Q42: The balances of the allowance for doubtful

Q43: Farmdale Company purchased three assets for $400,000.

Q57: What is the purpose of the date

Q66: What rights do preferred shareholders have that

Q101: Meadville Industries sells gift certificates that are

Q102: Forgetting to record depreciation expense during 2010l:<br>A)

Q112: A company deliberately and inappropriately included interest