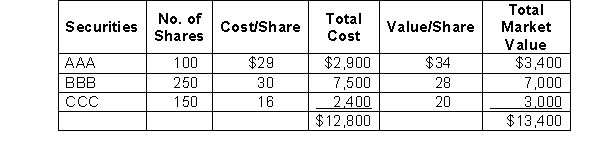

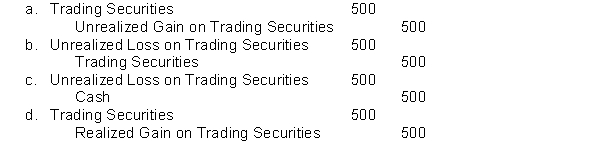

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, Solo sold all of its investment in AAA securities for $36 per share. The journal entry to record the 2009 revaluation of the AAA securities would be:

Early in 2010, Solo sold all of its investment in AAA securities for $36 per share. The journal entry to record the 2009 revaluation of the AAA securities would be:

Definitions:

Corporate Profits

The surplus income of a corporation after all expenses, including taxes and operational costs, have been deducted from total revenues.

Net Earnings

The amount of profit that remains after all operating expenses, taxes, and interest have been deducted from total revenue.

Interest Rate

The percentage at which interest is charged or paid on borrowed or saved money, often reflecting the cost of borrowing or the reward for saving.

Continuous Future

Refers to actions or events that are expected to continue over a period of time in the future.

Q25: The following information related to the marketable

Q26: The two fundamental ways in which financial

Q40: If a loss contingency related to a

Q42: Duncan Industries sold $100,000 of 12 percent

Q46: An 8% stock dividend was declared and

Q66: Current assets are assets which<br>A) can be

Q84: On October 1, Accurate Company borrowed $2,000

Q109: The amount of amortized bond premium<br>A) reduces

Q110: On January 1, a 3-year, $8,000, non-interest-bearing

Q120: Which one of the following is not