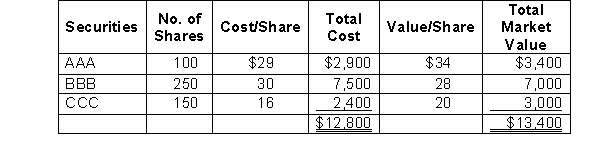

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the dividends received on the BBB securities and the dividends declared on the CCC stock in 2010 will include:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the dividends received on the BBB securities and the dividends declared on the CCC stock in 2010 will include:

Definitions:

Wage Determination

The process through which wages for labor are set, involving factors like supply and demand, bargaining power, and government policies.

Computer Software

A collection of data, programs, or instructions used to operate computers and execute specific tasks.

Accounting Services

Professional services that include the measurement, processing, and communication of financial information about economic entities.

College Graduate

A college graduate is an individual who has successfully completed a degree program at a college or university, earning an associate's, bachelor's, or higher degree.

Q20: If a company's collection period for accounts

Q46: Nokia Inc. reported beginning inventory of $90,000,

Q54: Several years ago, Welch Company purchased a

Q55: During a period of rising prices and

Q58: Tropical Corporation has the following amounts as

Q60: If a company issues a note payable

Q89: Which of the following changes describes the

Q91: An asset account<br>A) has a debit balance.<br>B)

Q91: The industry in which Carter is a

Q116: Distinguish between an installment obligation and a