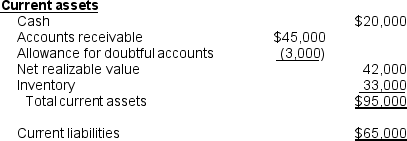

The following is a partial balance sheet for Quenton Company dated December 31, 2010:

During 2010, $4,000 of accounts receivable were written off as uncollectible and bad debts expense recognized on Quenton's 2010 net income statement was $8,000. However, the president of the company believes that $2,500 of these receivables were written off too soon. She believes that there is a good chance that they will be collected next year. There is some historical evidence to back the president's position.

During 2010, $4,000 of accounts receivable were written off as uncollectible and bad debts expense recognized on Quenton's 2010 net income statement was $8,000. However, the president of the company believes that $2,500 of these receivables were written off too soon. She believes that there is a good chance that they will be collected next year. There is some historical evidence to back the president's position.

A partial explanation for her position is that Quenton has a debt covenant requiring it to maintain a current ratio of 1.5. The president believes that by reversing the write-off of $2,500 of accounts receivable, the current assets will be $97,500 and the current ratio will be 1.5. However, the chief financial officer states that a better approach to getting the current ratio to 1.5 is to pay off some accounts payable. If the company paid $5,000 of accounts payable, the current ratio would become the minimum 1.5 required by the debt covenant.

Comment, with numerical illustration, on the president's and chief financial officer's positions.

Definitions:

Voluntary Intoxication

A legal defense claiming that a person's ability to understand the wrongfulness of his or her actions was impaired due to intentional consumption of alcohol or drugs.

Premeditation

The action of planning or plotting in advance, especially with intent to commit a specific act such as a crime.

Criminal Liability

The legal responsibility for a crime, involving the imposition of penalties or other legal consequences on a person who commits a criminal act.

Mens Rea

A legal principle referring to the criminal intent or state of mind of an individual at the time of an offense.

Q1: Farmdale Company's President purchased an extremely used

Q9: Which asset is more liquid, inventory or

Q18: An investor owns trading equity securities in

Q23: What must an analyst learn first prior

Q23: The following information comes from the annual

Q25: Desert Company has retained earnings of $12,000,

Q30: Favre Company paid for insurance in advance.

Q38: Everett, Inc.'s reporting period ends on June

Q50: Gump Supplies has the following information: <img

Q105: Calculate Laney's depreciation expense and loss (gain)