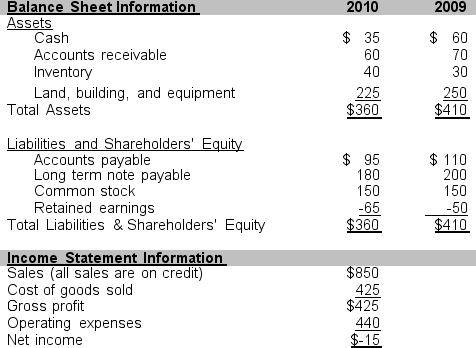

Use the information that follows taken from Campbell Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 45 through 48.

-Calculate Campbell's debt to equity ratio as of December 31, 2009 and as of December 31, 2010. Also assume that in Campbell's industry, the industry average debt to equity ratio is 2.75 as of December 31, 2009 and as of December 31, 2010.

A) Campbell's debt to equity ratio improved from 2009 to 2010.

B) Campbell's debt to equity ratio was better than average for the industry both years.

C)

C) Campbell's debt to equity is worse than average for the industry for both years.

D) Both a and b above, but not

Definitions:

Cost Behavior

The study of how specific costs change in relation to changes in a company's level of activity or volume of output.

Linear

Pertaining to or resembling a line; often used in mathematics to describe a relationship of direct proportionality.

Relevant Range

The range of activity within which the assumptions made about cost behavior are valid.

Variable Costs

Expenses that change in proportion to the amount of goods produced or the volume of sales.

Q20: Ruby uses the averaging cost flow assumption.

Q31: For each transaction listed in 1 through

Q31: Scottsdale Corp. received several invoices in the

Q32: Today's fair market value would be the

Q64: Beginning inventory is valued at $7,000, purchases

Q69: For each item listed in 1 through

Q75: What financial statement communicates cash flows from

Q93: If accounts receivable on January 1 totals

Q108: Camber Corp. owns 10% of Nova Corp's

Q119: Inventory on January 1 and December 31