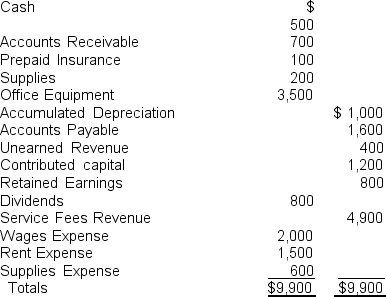

Use the information that follows taken from the unadjusted accounting records of Sheena, Inc. for the year ending December 31, 2010 to answer problems 24 through 26.

The following information is needed for adjusting entries at the end of December.

The following information is needed for adjusting entries at the end of December.

a. On December 31, 2010, the insurance expired amounted to $80.

b. Of the unearned revenue, $250 of services had been performed.

c. Services have been performed for customers that have not yet been billed or paid totaling $180.

d. The office equipment computation for 2010 depreciation amounts to $200.

-What is the effect on net income of each of the adjusting entries necessary for Sheena, Inc.?

Definitions:

Q3: An annuity due and an ordinary annuity

Q5: What is the best estimate of the

Q7: Sheena Company has accounts receivable of $13,000,

Q29: Cagey Trading Inc. counted $2,000 of inventory

Q39: For each financial statement item listed in

Q62: Financial flexibility is<br>A) a good indicator of

Q66: The following information related to the marketable

Q89: Which one of the following is violated

Q92: Victor Corporation purchased a packaging machine on

Q106: During a period of rising prices and