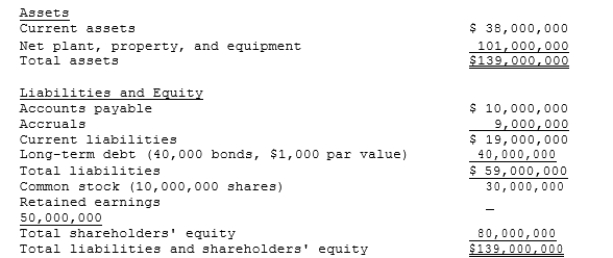

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable

The stock is currently selling for $15.25 per share, and its noncallable

$1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-What is the best estimate of the after-tax cost of debt?

Definitions:

ULPA

A high-efficiency air filter standard known as Ultra Low Particulate Air, capable of removing at least 99.99% of dust, pollen, mold, bacteria, and other airborne particles.

Limited Partner

An investor in a partnership who is not involved in daily business operations and whose liability is limited to the amount of their investment.

Withdraw

To remove oneself or something from consideration, participation, or engagement in a particular activity, agreement, or situation.

Managers of the LLC

Individuals or entities appointed or elected to manage the operations of a Limited Liability Company in accordance with its operating agreement.

Q31: The <u>before-tax</u> cost of debt, which is

Q32: Today's fair market value would be the

Q36: What financial statement would you review to

Q43: 5-year Treasury bonds yield 5.5%. The inflation

Q46: Describe how the equity sections of balance

Q72: For each financial concept listed in 1

Q78: Tucker Corporation is planning to issue new

Q85: Pasco Co. borrowed $20,000 at a rate

Q116: Which of the following statements is CORRECT?<br>A)

Q120: Suppose a bank offers to lend you