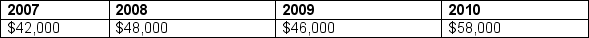

The net income amounts for Box and Wood, Inc. over a four-year period is as follows:

After further examination of the financial report, you note that Box and Wood, Inc. made accounting method changes in 2008 and 2010, which affected net income in those periods. In 2008, the company changed depreciation methods. This change increased the book value of its fixed assets in each subsequent year by $10,000. In 2010, the company adopted a new inventory method that increased the book value of the inventory by $18,000.

After further examination of the financial report, you note that Box and Wood, Inc. made accounting method changes in 2008 and 2010, which affected net income in those periods. In 2008, the company changed depreciation methods. This change increased the book value of its fixed assets in each subsequent year by $10,000. In 2010, the company adopted a new inventory method that increased the book value of the inventory by $18,000.

Requirements:

a. Calculate the effect of each of these changes on net income in the year of the change.

b. Prepare a chart that compares net income across the four-year period, assuming that Box and Wood, Inc. made no accounting changes. How would your assessment of the company's performance change after you learned of the accounting method changes?

c. What principle of financial accounting makes it difficult to make such changes? Describe the conditions under which Box and Wood, Inc. would be allowed to make changes in their accounting methods.

Definitions:

Getting Some Food

The act of obtaining food to satisfy hunger, which can encompass a range of behaviors from purchasing food at a store to preparing a meal.

Sleeping

The natural state of rest for the mind and body, characterized by altered consciousness and reduced sensory activity.

Jogging

A form of aerobic exercise involving running at a slow or leisurely pace, aimed at improving fitness and cardiovascular health.

Arousal Theory

The theory suggesting that people are motivated to maintain an optimal level of arousal, neither too high nor too low.

Q5: Which one of the following statements is

Q17: A time line is meaningful even if

Q20: Ocean Corporation purchased a machine with a

Q29: Why are 'unearned revenues' considered liabilities?

Q40: What business aspect does the statement of

Q66: Given below are several accounts from Caterpillar

Q71: Which of the following is <u>NOT</u> a

Q89: Where would you most likely find a

Q94: You plan to analyze the value of

Q98: Which of the following statements regarding a