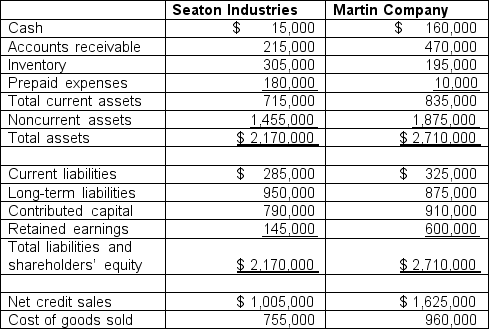

-You have just been hired as a loan officer for Coastline Bank and Trust. Seaton Industries and Martin Company have both applied for $125,000 nine-month loans. It is the strict policy of the bank to have only $1,350,000 outstanding in unsecured loans at any point in time. Since the bank currently has $1,210,000 in unsecured loans outstanding it will be unable to grant loans to both companies. The bank president has given you the following selected information from the companies' loan applications.

Required: Assume that all account balances on the balance sheet are representative of the entire year. Based on this limited information, which company would you recommend to the bank president as the better risk for an unsecured loan? Support your answer with any relevant analysis, including examination of the current ratio, quick ratio, receivables turnover, and inventory turnover.

Required: Assume that all account balances on the balance sheet are representative of the entire year. Based on this limited information, which company would you recommend to the bank president as the better risk for an unsecured loan? Support your answer with any relevant analysis, including examination of the current ratio, quick ratio, receivables turnover, and inventory turnover.

Definitions:

EPA

The Environmental Protection Agency, a U.S. federal agency responsible for protecting human health and the environment.

Safe Drinking Water Act

A federal law enacted in the United States in 1974 to protect public drinking water supplies from harmful contaminants.

Primary Drinking Water Standards

Federal standards established by the EPA to protect public health by limiting the levels of contaminants in drinking water.

Superfund

A U.S. federal government program established to fund the cleanup of sites contaminated with hazardous substances and pollutants.

Q8: Thomas Young invested $15,000 at 10% annual

Q8: Bosio Inc.'s perpetual preferred stock sells for

Q18: If the industry in which Carter is

Q27: Which of the following statements is CORRECT?<br>A)

Q43: You were recently hired by Scheuer Media

Q45: The accounting period is the time<br>A) the

Q73: You plan to analyze the value of

Q74: The following information is shown on Morris

Q87: During 2010, Hamot Company sold $30,000 of

Q88: Buffalo Company has current assets, current liabilities,