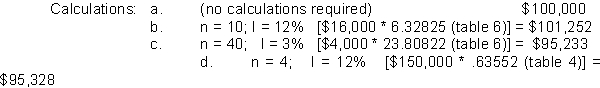

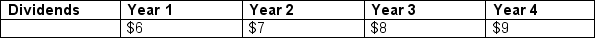

-Kaitlin is contemplating investing in Cocoa Beach Tans. She estimates that the company will pay the following dividends per share at the end of the next four years and that the current price of the company's common stock, which is $100 per share, will remain unchanged.  If Kaitlin wants to earn 12 percent on her investment and plans to sell the investment at the end of the fourth year, how much would she be willing to pay for one share of common stock? (Round all calculations to the nearest cent.)

If Kaitlin wants to earn 12 percent on her investment and plans to sell the investment at the end of the fourth year, how much would she be willing to pay for one share of common stock? (Round all calculations to the nearest cent.)

Definitions:

Q14: The following information is available on four

Q16: Which one of the following reflects the

Q19: Which of the following statements is CORRECT?<br>A)

Q30: Moerdyk Corporation's bonds have a 10-year maturity,

Q58: The CAPM is built on historic conditions,

Q61: The cost of debt is equal to

Q61: The industry in which Tyler operates has

Q63: Which one of the following groups of

Q67: Which of the following statements is CORRECT?<br>A)

Q69: O'Brien Inc. has the following data: rRF