-For each of the following situations in A through D, indicate the abbreviation of the table that should be used to solve for the solution requested. Place the abbreviation of the respective table in the space provided. You may use each table more than once or not at all.

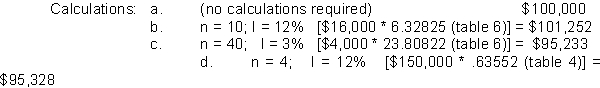

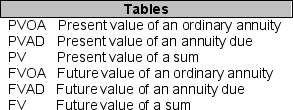

_______A. How much would an investor deposit today in order to withdraw $12,000 at the beginning of each of the next four years, assuming that the first payment is withdrawn one year from today?

_______A. How much would an investor deposit today in order to withdraw $12,000 at the beginning of each of the next four years, assuming that the first payment is withdrawn one year from today?

_______B. If interest rates are compounded semi-annually, how much will a company accumulate in three years after making six equal semi-annual payments of $15,000 each? The first payment will be made today.

_______C. If interest rates are compounded monthly, how much can a company withdraw per month for 6 months beginning one month from now if $100,000 is deposited today?

_______D. You want to buy a house for $200,000 and finance it with interest compounded monthly. If it is financed over a 12?year period, what will be the amount of each annual payment, the first of which will be due at the beginning of the first year?

Definitions:

Online Conversations

Exchanges of messages or communication between people over the internet or through digital platforms.

Unconscious Thought

Mental processes that occur without conscious awareness, influencing feelings, reactions, and decisions covertly.

Polychronic Activity

Engaging in more than one activity or behavior at a time.

Central Route

A process in persuasive communication where the recipient elaborately thinks about the arguments and content, leading to a lasting attitude change.

Q9: A stock's beta measures its diversifiable risk

Q25: How does the accrual for wages relate

Q30: The preemptive right is important to shareholders

Q54: In order to accurately assess the capital

Q54: Which one of the following is violated

Q57: What business aspect does the income statement

Q77: Describe the two components of the income

Q90: If the balance sheet is in balance,<br>A)

Q101: A stock with a beta equal to

Q108: CCC Corp has a beta of 1.5