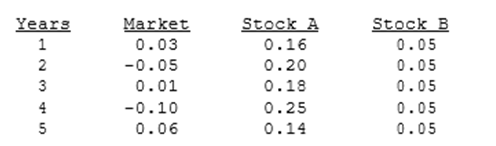

You have the following data on (1) the average annual returns of the market for the past 5 years and (2) similar information on Stocks A and B. Which of the possible answers best describes the historical betas for A and B?

Definitions:

Oligopoly Environment

An oligopoly environment is a market structure characterized by a small number of large firms dominating the market, leading to limited competition and potentially cooperative behavior among companies.

Competitive Advantages

Unique attributes or circumstances that allow an organization to outperform its competitors.

Excessive Business Profits

Refers to the disproportionately high earnings that a business may make, often seen as beyond what is considered fair or reasonable in relation to its production costs or societal contributions.

Strategy Implementation

The process of putting a chosen strategy into action to achieve an organization's goals and objectives.

Q5: A firm's peak borrowing needs will probably

Q6: Which of the following is true of

Q7: Credit standards refer to the financial strength

Q7: Although it is extremely difficult to make

Q8: A congeneric merger is one where the

Q13: Heaton Corp. sells on terms that allow

Q25: Which of the following statements is CORRECT?<br>A)

Q43: As a firm's sales grow, its current

Q61: Vu Enterprises expects to have the following

Q81: Margetis Inc. carries an average inventory of