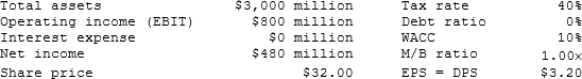

A consultant has collected the following information regarding Young Publishing:  The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) . The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?

The company has no growth opportunities (g = 0) , so the company pays out all of its earnings as dividends (EPS = DPS) . The consultant believes that if the company moves to a capital structure financed with 20% debt and 80% equity (based on market values) that the cost of equity will increase to 11% and that the pre-tax cost of debt will be 10%. If the company makes this change, what would be the total market value (in millions) of the firm?

Definitions:

Q1: We will almost always find that the

Q2: The cash balances of most firms consist

Q3: A convertible debenture can never sell for

Q10: If the information content, or signaling, hypothesis

Q15: If the shape of the curve depicting

Q32: Although goodwill created in a merger may

Q37: A firm will use spontaneous funds to

Q54: The firm's target capital structure should be

Q69: Firms generally choose to finance temporary current

Q98: A firm is considering Projects S and