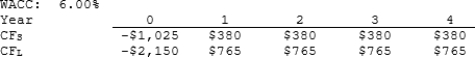

A firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favors the NPV method. You were hired to advise the firm on the best procedure. If the wrong decision criterion is used, how much potential value would the firm lose?

Definitions:

Q2: Which of the following statements is CORRECT?<br>A)

Q4: y = -mx

Q14: Determining a firm's optimal investment in working

Q17: Which of the following factors should be

Q23: <span class="ql-formula" data-value="- x y ^ {

Q25: A reverse split reduces the number of

Q35: Exchange rate quotations consist solely of direct

Q62: The relative profitability of a firm that

Q79: <span class="ql-formula" data-value="y ^ { \prime }

Q444: The force <span class="ql-formula" data-value="\mathrm