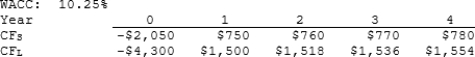

Sexton Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used.

Definitions:

Just-World Phenomenon

A cognitive bias that leads individuals to believe that the world is inherently fair, leading them to rationalize an unwarranted, good or bad situation as deserving.

Natural Disaster

Severe, catastrophic events resulting from natural processes of the Earth, such as earthquakes, floods, hurricanes, and volcanic eruptions.

Punished

The administration of a negative consequence or removal of a positive stimulus following an undesired behavior, with the intention of decreasing that behavior's occurrence in the future.

Transgender Man

An individual whose gender identity is male but was assigned a different sex at birth.

Q8: Zhdanov Inc. forecasts that its free cash

Q24: If debt financing is used, which of

Q61: Vu Enterprises expects to have the following

Q61: Fernando Designs is considering a project that

Q79: Although short-term interest rates have historically averaged

Q96: <span class="ql-formula" data-value="\int \frac { 75 x

Q107: <span class="ql-formula" data-value="\int _ { - \pi

Q207: <span class="ql-formula" data-value="\int \sin \theta \cos \theta

Q332: <span class="ql-formula" data-value="\frac { x ^ {

Q351: <span class="ql-formula" data-value="\frac { 5 x +