(The following data apply to Problems 63, 64, and 65. The problems MUST be kept together.)

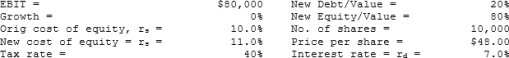

Volunteer Fabricators, Inc. (VF) currently has zero debt. It is a zero growth company, and it has the data shown below. Now the company is considering using some debt, moving to the market value capital structure indicated below. The money raised would be used to repurchase stock. It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat, as indicated below.

-Now assume that VF is considering changing from its original zero debt capital structure to a new capital structure with even more debt. This results in changes in the cost of debt and equity, and thus to a new WACC and a new value of operations. Assume VF raises the amount of new debt indicated below and uses the funds to purchase and hold T-bills until it makes the stock repurchase. What is the stock price per share immediately after issuing the debt but prior to the repurchase?

Definitions:

Overtime

Time worked by employees beyond their normal working hours, typically compensated at a higher pay rate.

Subcontracting

The process of assigning specific portions of work or projects to external parties or businesses.

Short-term Production

The process of manufacturing goods or services over a relatively brief period, focusing on immediate output and efficiency.

Broad Blueprint

A comprehensive plan or strategy outlining the main components and goals of a project or initiative.

Q1: Which one of the following aspects of

Q6: A lease versus purchase analysis should compare

Q9: The option to abandon a project is

Q14: The easier a firm's access to borrowed

Q19: Orient Airlines' common stock currently sells for

Q37: Which of the following statements is NOT

Q57: Poulsen Industries is analyzing an average-risk project,

Q72: Conflicts between two mutually exclusive projects occasionally

Q372: A right pyramid has a rectangular base

Q386: Use <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg" alt="Use to