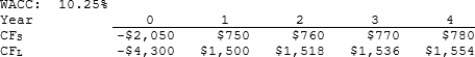

Sexton Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used.

Definitions:

Underweight

Being below the weight considered normal or healthy for a person's age, height, and body type.

Spices

Substances derived from plants, used for flavoring, coloring, or preserving food, and may have health benefits.

Hot Climates

Refers to regions of the world characterized by high temperatures for most of the year.

Colder Climates

Regions with lower average temperatures, often characterized by longer winters and shorter summers, affecting living conditions and lifestyle.

Q12: Which of the following statements is CORRECT?<br>A)

Q39: Sub-Prime Loan Company is thinking of opening

Q46: Companies HD and LD have identical amounts

Q73: Nast Inc. is considering Projects S and

Q142: For a circle of radius r, the

Q168: A right rectangular prism has a base

Q307: In the figure, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7237/.jpg" alt="In the

Q584: The radius of an equilateral triangle measures

Q657: For a right circular cylinder, the length

Q852: The triple (20,21,29) is a Pythagorean Triple.