A two-part question.

-(Part A) Dependence detection

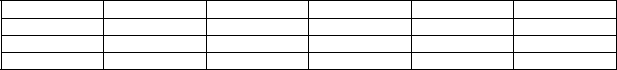

This question covers your understanding of dependences between instructions. Using the code below, list all of the dependence types (RAW, WAR, WAW). List the dependences in the respective table (example INST-X to INST-Y) by writing in the instruction numbers involved with the dependence.

I0: A = B + C; I1: C = A - B; I2: D = A + C;

I3: A = B * C * D;

I4: C = F / D;

I5: F = A ˆ G;

I6: G = F + D;

Definitions:

Transferred Out

In manufacturing and accounting, refers to goods or materials that have been moved from one process or department to another in the production process.

Weighted-Average Method

A cost-flow assumption used in inventory valuation and costing, calculating the cost of goods sold and ending inventory based on a weighted average of costs.

Equivalent Unit

A concept used in process costing that represents the amount of work done on incomplete units, expressed in terms of fully completed units.

Weighted-Average Method

An inventory costing method that calculates the cost of ending inventory and the cost of goods sold based on the average cost of all inventory units.

Q1: The five stages described by L.E. Greiner

Q8: Assume the load factor threshold is 75%.

Q14: Power is:<br>A) The source of all leadership.<br>B)

Q20: Suppose the rule of the party is

Q20: A processor has a 32 byte memory

Q28: CADD is the acronym for what?

Q29: Name the standard developed by a group

Q37: Identify the alloying elements in brass.

Q48: What are the properties of white cast

Q48: Describe the types of drawing created by