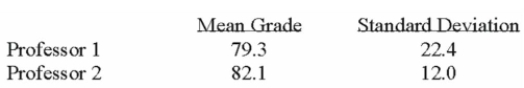

Two accounting professors decided to compare the variation of their grading procedures. To

Accomplish this they each graded the same 10 exams with the following results:

At the 1% level of significance, what is the decision?

Definitions:

Adjusting Entry

An accounting entry made at the end of an accounting period to allocate income and expenditure to the appropriate period for a more accurate financial statement.

Depreciation

The process of allocating the cost of a tangible asset over its useful life, reflecting its loss of value over time.

Equipment

Tangible assets used in the operation of a business, such as machinery, computers, and tools.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset from the time it was put into service until a particular date.

Q20: A sales manager for an advertising agency

Q36: i. Violating the need for successive observations

Q37: Which of the following actions would be

Q39: Colleen Waite, Director of General Canadian Sales,

Q41: To compare the effect of weather on

Q57: Random sample of executives from companies with

Q72: Which of the following statements is correct?<br>A)

Q79: A random sample of 30 executives from

Q105: A sample of General Mills employees was

Q142: What can we conclude if the coefficient